“There are no solutions. There are only trade-offs.” –Thomas Sowell

“Goldilocks went upstairs. She lay down on the big bed and said, ‘This bed is too hard!’ She lay on the medium bed and said, ‘This bed is too soft!’ She lay down on the small bed and said, ‘This bed is just right.’ She fell asleep.” –Robert Southey

The above quote from Thomas Sowell ranks among my favorites. If you are unfamiliar with Dr. Sowell, I encourage you to read his books or watch his interviews. Whether or not you agree with his conclusions, you will appreciate his thoughtfulness.

Tradeoffs is exactly what the Federal Reserve is dealing with these days. Inflation has become enemy number one after hibernating for more than a decade. This is a shift from inflation’s more sinister partner in crime known as deflation. Deflation has been the target of the Fed since the Great Financial Crisis and almost brought the global economy to its knees.

In its fight against these two enemies, the Federal Reserve has one or two weapons at its disposal. They are interest rates and asset purchases. The rub is that work works against one raises the risk of agitating the other. Another tradeoff. It is a tough job switching from one weapon to the other which is why we are experiencing an elevated level of volatility right now.

As readers of our commentary know, since The Great Recession, there has been a deflationary “vortex” gobbling up the monetary stimulus injected into the economy. If not for this stimulus, deflation would have taken hold of the economy and The Great Recession would have become another Great Depression.

While everyone in the economy has benefited from the low interest rates and liquidity brought about by the Fed’s war against deflation, it has come at a price. Persistently low interest rates and stimulus distort price discovery in the market and can lead to bubbles forming.

It has been a pitched battle between monetary policy and deflation. Without any help from Congress and the President, the war has waged on leaving the Federal Reserve with no ability to raise interest rates without giving up ground to deflation. To keep deflation at bay, the Fed has kept its foot on the accelerator of monetary stimulus.

In March 2020 things changed. COVID pushed Congress and the President to act decisively with fiscal stimulus to push back the deflation that would overwhelm the economy during the lockdown. A war-time call-to-arms led the Federal Reserve and Congress/President to destroy deflation though a combined monetary and fiscal stimulus assault the likes of which we have not seen since World War 2.

The combined effort worked, but there was a tradeoff. While the massive stimulus destroyed the remnants of deflation left over from The Great Recession, it awakened the enemy named inflation. Now we see inflation as a bigger threat than deflation.

Inflation feasted on the massive amount of liquidity (cash) sloshing around the economy. It has grown like a weed due to the supply chain disruptions caused by the global lockdown. It has grown like a cancer from the increased demand for goods at a time when supply chains could not deliver enough goods and services.

Global issues, like the war in Ukraine, has done its part to reduce global energy supplies, disrupt agricultural markets and raise the fear that any war brings to the world. The European Central Bank faces similar threats to their economy as the Fed faces here.

This is the year the Federal Reserve will fight inflation after a 10-year war against deflation. They will win the war but there will be tradeoffs that investors and consumers alike will need to adjust to. The volatility in markets today is rooted in investors shifting their positions from a stimulus-driven economy to one where the Fed is pulling back on stimulus.

The Fed will raise rates to prevent inflation from taking control of the economy. Higher rates will function as a headwind to economic activity. It will take more effort by companies to generate profits as wages and supply costs rise. Consumers will struggle to buy the same amount of goods and services this year that they did last year. Capital will be more expensive as interest rates rise.

The battle against inflation will not last as long as many fear it will. The Fed will bring inflation down, some jobs will be lost, and economic activity will slow. However, the tradeoff is better than the alternative and will lead to a stronger and healthier economy. Let us not forget the economy strengthened after The Great Recession and it will do so again once the Fed’s work is done.

The quote above from Goldilocks reminds me of the work the Federal Reserve has in front of it. It is searching for the right bed (think interest rates) to use. They will try different beds (rate hikes) until they find the one that fits. Then they will rest, and stocks will move higher.

For now, here are some observations about what we see in the stock and bond markets and some charts to support our view.

Tomorrow the Fed will announce where they are taking interest rates along with providing their view of the future. We expect the Fed to raise interest rates by seventy-five basis points (3/4 of 1%) and set the stage for another 75bps hike in July. The market has told the Fed they think it has fallen behind the curve and the Fed wants to catch up. The tradeoff to this move by the Fed could very well be that they need to do less at future meetings to bring inflation down. We expect this to be the case.

Below is a chart that shows the Fed Funds rate since 2006. As you can see, the rate was north of 5% prior to The Great Recession and fell dramatically through 2015. In December 2015, the Fed hike rates nine times before reversing course in 2019 and then going back to zero when COVID hit. The uptick that shows on the right part of the chart tells you where we are in relation to previous levels. The current target for Fed Funds is around 4% which is still well below levels we saw in 2007 and we are not sure we will even see 4%.

The next chart also shows the Fed Funds rate but goes back to 1955. As you can see, the Fed Funds rate has been much higher historically than we have experienced lately. After such an extended period of zero interest rates, a “recency bias” affects how a subtle change in rates feels. Just like standing up after a long sit feels a bit jarring, the same is true for the economy when the Fed hikes rates. It takes a while to get its bearing. Will we see rates spike to levels shown on this chart? We do not expect to see rates anywhere near the 5%+ levels for years to come.

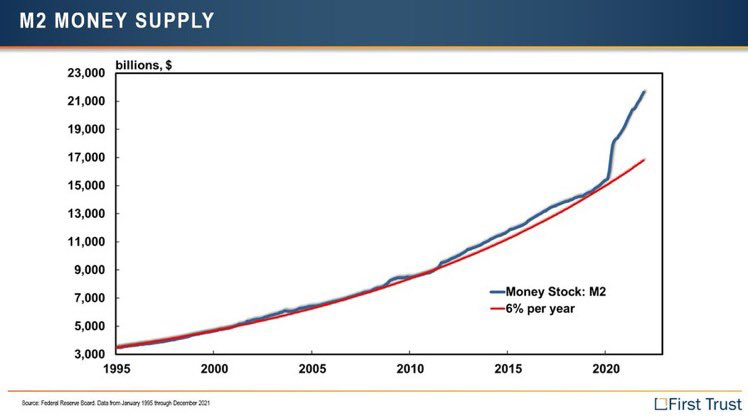

Earlier we mentioned the unprecedented amount of liquidity injected into the economy in response to the COVID lockdown. The chart below illustrates, by way of the money supply (M2), how the money supply rose above the normal 6% growth rate during COVID. The blue line helps to see where the inflation we feel today stems from. The Fed is working to remove that excess liquidity and return M2 to the 6% trajectory it was on before COVID. Once it gets us there, expect the Fed to back off and the market to settle down.

The stock market just entered “bear market” territory the other day. A bear market occurs when the stock market declines by 20% from its peak. Dating back to World War 2, the chart below offers a look at how stocks have behaved after entering bear market territory. The right column shows how stocks have performed in the 12 months that follow a bear market. In fourteen instances, eleven of them have seen stocks move higher. The average return for these fourteen periods has been 17.7%. Past performance does not guarantee future results.

Investors are concerned about the prospect of another Great Recession or housing crisis given the rapid rise in interest rates. As the Fed raises interest rates homes become less affordable. But that is exactly what the Fed is shooting for, at least in the short term.

Interestingly, the chart below shows that, while homes are undoubtedly more expensive, the short supply of homes will reduce the risk of a housing crash like we saw in 2008. If homes retain their value, due to limited supply, this will give confidence to consumers who do not feel their home is a depreciating asset.

Another indicator that supports the view of a soft landing or at least a shallow recession is employment data. One tradeoff to paying people to not work during the lockdown was it put the government in direct competition with businesses for employees. With increased competition for labor, rising wages ensued which contributed to inflation.

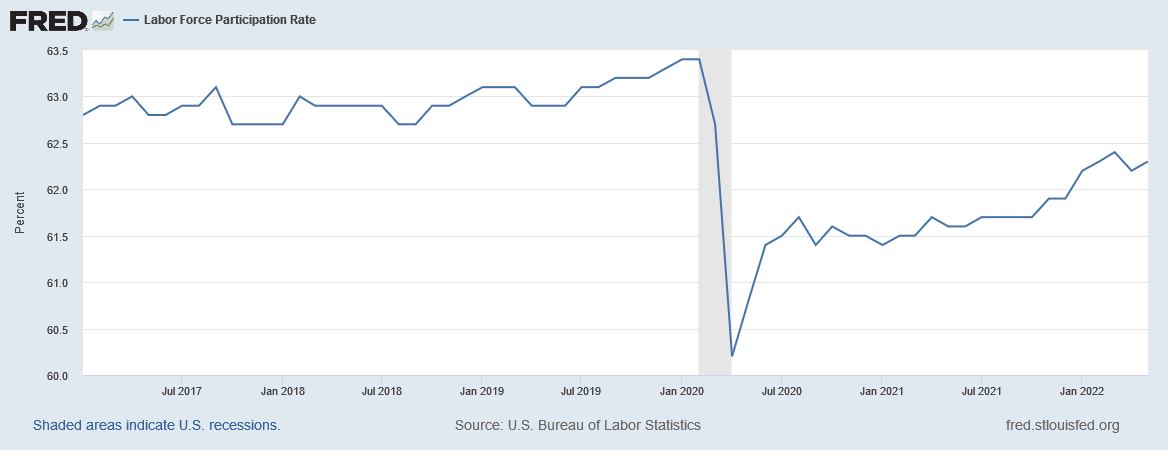

The two charts below show that persistent unemployment and the labor participation rate are moving in the right direction to remedy the perversion to the job market that happened during COVID.

In the first chart, we see that unemployment lasting more than 27 weeks (6 months) has declined to pre-COVID levels. This is a healthy sign that people are not choosing unemployment over keeping their job.

In the second chart we see the Labor Force Participation Rate continues to improve. As the participation rate increases, it signals that people are choosing to enter the job market which will help reduce supply chain issues.

In conclusion, The Long Hot Summer for stocks will continue to be plagued by volatility. It will not be surprising to see a few rip-roaring rallies in stocks followed by painful reversals as the excess liquidity is “burned off.”

Unemployment will begin to rise as the Fed raises interest rates. This will be painful for many workers and their families, but it will help reduce the rate of inflation.

The price of oil will continue to push higher (Remember when oil futures traded at a negative price a couple of years ago?) but not significantly. Demand destruction is taking place. This means that the demand for oil is softening. Supply and demand dynamics will begin to equalize and bring prices down as the year progresses.

The Federal Reserve will do everything necessary to bring inflation down. They will also be keen to stop short of wrecking the economy in the process. If inflation begins to moderate in a material way, the Fed will step back from further rate hikes. This will be good news for stocks.

Here at Kessler Investment Group, we continue to work hard at navigating these volatile markets. Our decision to overweight exposure to energy stocks heading into this year help performance and offset declines in technology and financial stocks. We also raised cash in our managed accounts to shrink our exposure to stocks as weakness took hold.

The team here at KIG has been building a “wish list” of stocks that we would like to buy for clients at lower prices. Our focus has turned to companies with strong Return on Equity and Return on Assets characteristics. These are the companies we think will perform well during a rising rate environment.

While it is never easy to go through down drafts like we find ourselves. With over one hundred years of combined professional experience in the investment management profession, all of us here at KIG thank you for your business and trust during these tough times.

Sincerely,

Kessler Investment Group, LLC

All information in this presentation is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. All economic performance data is historical and not indicative of future results. The market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Certain statements contained within are forward looking statements including, but not limited to, statements that are predictions of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Please consult your adviser for further information.

Opinions shared in this presentation are not intended to provide specific advice and should not be construed as recommendations for any individual. Please remember that investment decisions should be based on an individual’s goals, time horizon, and tolerance for risk.