Stock market selloffs never feel good as they are happening. It is human nature to feel fear during a downturn just as it is natural to feel greed during rallies. After all, they are two sides of the same coin. Fear and greed offer balance in a market that otherwise appears chaotic.

Given that the main catalyst for the current decline in stocks originated in China, I find it easy to pull from the wisdom of Chinese philosophy to help understand the decline. The concept of Yin and Yang is worth keeping in mind when markets begin to move in one direction for an extended period. Chinese philosophy teaches that these two forces exist in harmony with one another…like two sides of the same coin. Essentially, the concept of Yin and Yang is tied to the view that in danger we find opportunity and in opportunity we find danger.

While I am overly simplifying this centuries-old concept, it helps us to see the current market decline for what it is. That is, a decline which provides opportunities for investors. Just as the recent rally obscured some of the dangers we currently face. Yet, this is always the case, isn’t it?

So, what “opportunity” do I see in the recent selloff? Well, many stocks in companies that have little exposure to the panic surrounding Coronavirus offer the best opportunities. In fact, there are many companies that will benefit from a shift in behavior of people reacting to the threat of the virus. Examples include; companies in the computer gaming field, online retailers, certain biomedical companies, streaming media companies, etc.

What are the “dangers”? Earnings from companies broadly tied to travel and consumer spending could impact other sectors of the economy beyond their own. An escalation of the outbreak in areas not directly tied to China could heighten fear to critical levels. All of which could lead to a global recession sooner than we expect.

As is always the case, when markets begin to turn lower, here at KIG, we work hard to understand the catalyst and determine the likely reaction of the government, consumers, suppliers and investors. Further, it is important to understand from where the market is moving. In other words, does the selloff follow a recent rally? Does it represent another leg lower following what was already a difficult market? Has a major political event (election) or some other “rare” event preceded the move? These are questions that are relevant to our work.

As of today, our view is that the market is “finally” reacting to the Coronavirus. Until the past few days, the market continued to rally in the face of mounting evidence that the virus was spreading around the world. The market’s reaction is a positive, in our view, as it shows there is no “blind optimism” in the marketplace. Any time the market completely ignores a major global negative event it means complacency is too high. So, stocks selling off because of a global virus is “normal” and therefore suggests there is no “complacency”.

The selloff likely has a little further to go before it has run its course. Like every selloff that has come before, it will go too far to the downside. We believe it will go “too far” very soon. A rally is coming, and we believe it will be a strong one and last into the summer.

For our managed accounts, we are looking at companies, which we already own, for opportunities to buy. Companies like Disney, Amazon, Peloton and Kellogg’s that are able to either benefit from a shift in consumer behavior or have no exposure to the Chinese market at all, look attractive.

From a technical perspective, the 3,030 level on the S&P 500 (approximately 3% lower than today’s close) is where we expect a low to be reached. If that level does not hold then we will re-evaluate our thesis. Our view is that stocks will reach a “crescendo low” soon. This does not mean we expect stocks to immediately reverse course and head higher. A period of consolidation is likely before an upward trend develops. Regardless, we expect the selloff to run its course soon and stocks to resume their climb higher.

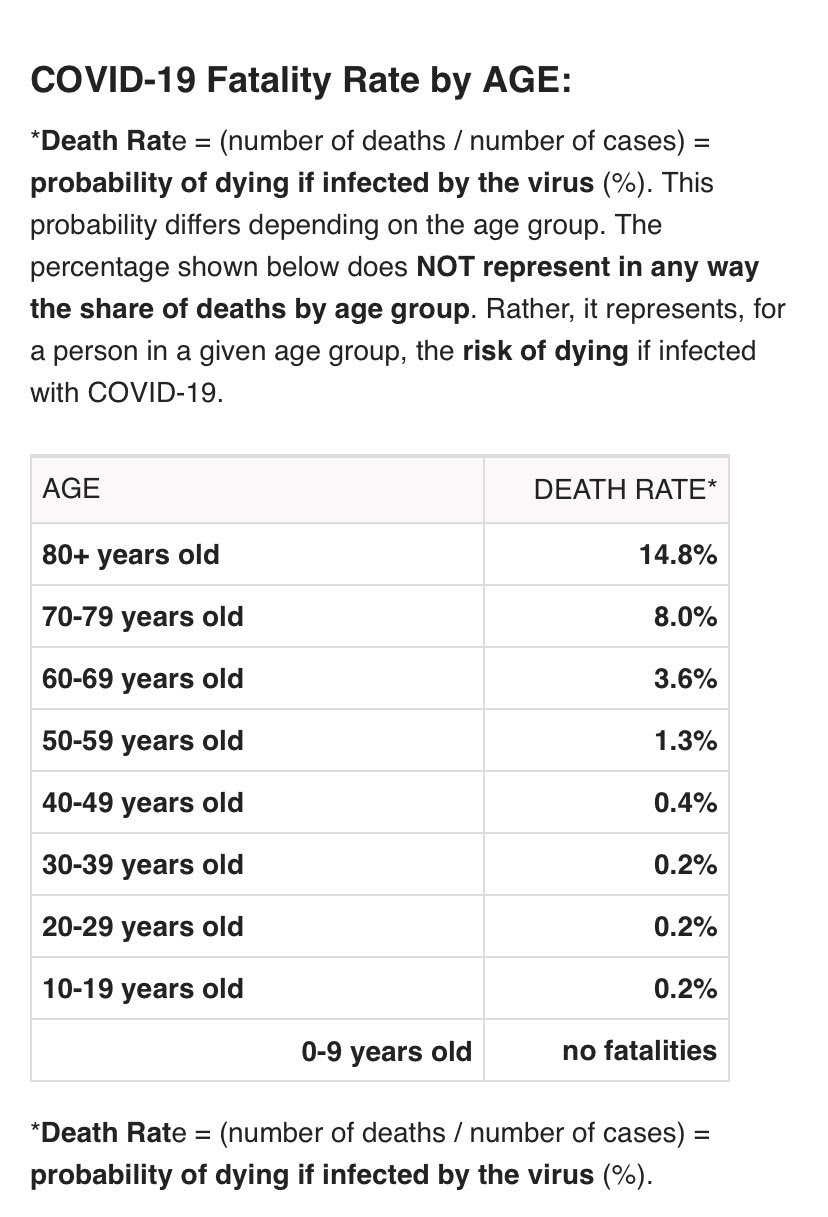

As a final note, we offer the chart below to put into perspective the impact of the virus. It shows that the death rate is less than what the press coverage might suggest. The mortality rate is highest among those most susceptible to its effects. Namely, those who are older and suffer from chronic illness. Of course, it is devastating to every person, and family, affected. However, the impact on the global economy is unlikely to reach devastating levels given the low mortality rates.

Source: Chinese Center for Disease Control and Prevention

Sincerely,

Kessler Investment Group, LLC