Dear Valued Clients,

As we traverse the ever-evolving landscape of financial markets, I am honored to share insights into our current economic state and our forward-looking investment strategy.

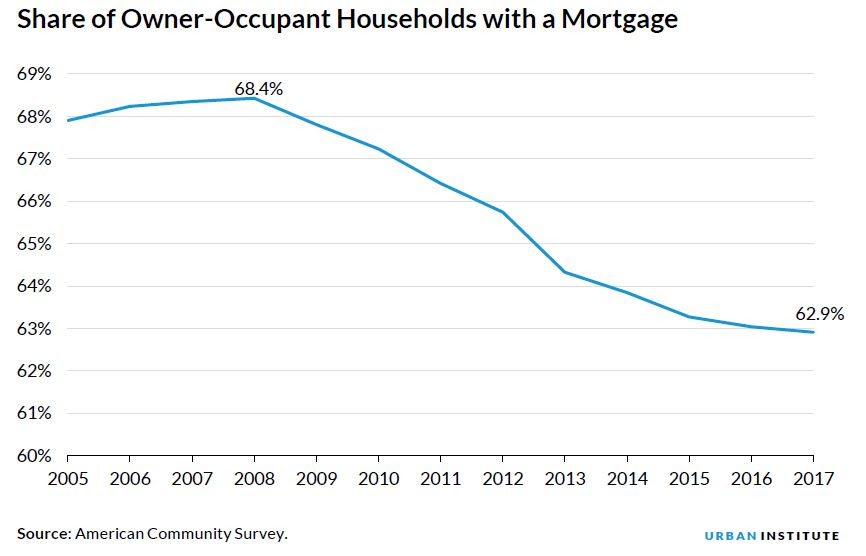

Underpinning Economic Strength: My team and I would like to emphasize the resilience of our economy’s foundational elements. Key indicators portray robustness, providing a sturdy base for our investment approach. Notably, nearly 40% of homeowners are mortgage-free, and a majority with mortgages are locked into rates below 3.5%. This mirrors a trend of prudence post-financial crises, with individuals adopting more careful spending habits. Paying off mortgages and reducing credit card debt indicate a healthier financial stance, reflecting a recharged financial landscape.

With rising property values and increased home ownership, household net worth is ascending, contrasting starkly with the turmoil of the Great Recession. Moreover, escalating wages and declining inflation bolster consumer purchasing power, a driving force behind 70% of the US economy.

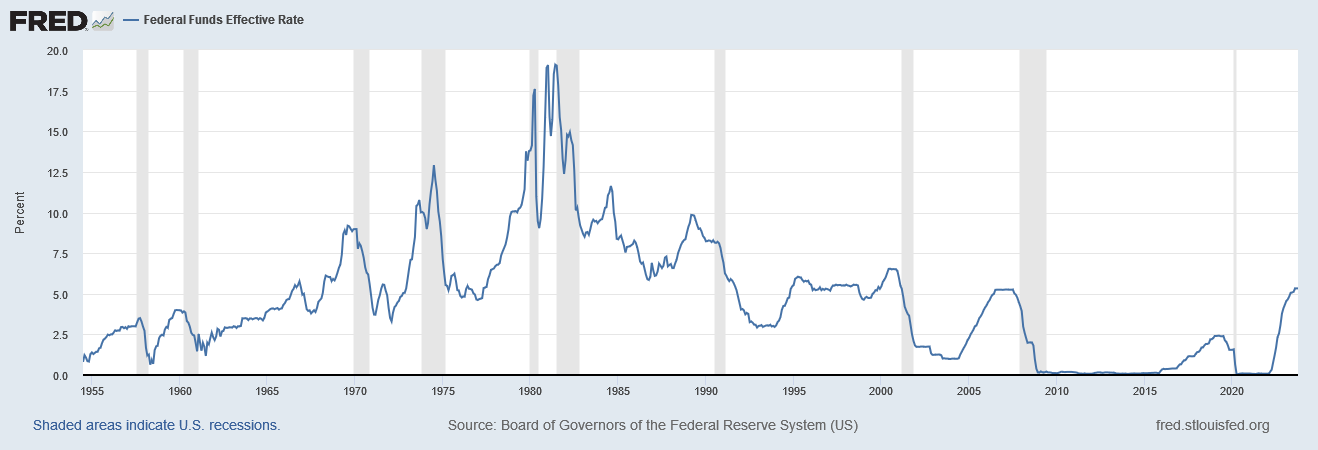

Interest Rates and Federal Reserve’s Position: Analysis of recent Federal Reserve actions suggests the conclusion of interest rate hikes. In fact, we anticipate an imminent rate cut, signaling the Fed’s commitment to sustaining economic growth amidst evolving conditions. This shift will likely prompt positive stock reactions, fostering a normalized yield curve, which in turn facilitates efficient capital allocation, benefiting the broader economy.

Inflation and Economic Projection: Inflation’s downward trajectory should continue into 2024. The Federal Reserve’s target remains at 2% for inflation. To us this seems possible without further rate hikes. While recession concerns persist, indications point to a potentially shallow and brief downturn, resembling the mild impact of the 1990 recession—a refreshing pause before renewed economic vigor.

Stock Market Performance: Despite recession possibilities, our outlook on stock performance over the next 5-7 years remains optimistic. Rising interest rates signify recovery from the “Zero Interest Rate Policy” era, akin to the strong stock performance following the 1990 recession.

Interest Rates and Capital Allocation: Normalized interest rates denote a shift towards efficient capital allocation, allowing investors to make informed decisions and reap benefits from well-considered investments.

Artificial Intelligence and Economic Productivity: AI’s potential to enhance productivity across sectors counters inflationary pressures. Much like the Internet’s impact on the 1990s economy, AI’s influence on productivity will be profound in the coming years, countering inflationary pressures.

Outlook for Stocks and S&P 500: Parallel to the prosperous 1990s, our forecast for stocks over the next 5-10 years is notably upbeat. Anticipate the S&P 500 Index reaching all-time highs within 3-6 months. While volatility persists, missing potential gains seem avoidable, given the current economic climate.

Conclusion: We do not want to give you the belief that our outlook is so rosy that we are in a “buy and hold” mode. There are risks to our forecast and we must be willing and able to adjust to changing conditions. We always reserve the right to be wrong, but we never shirk from our duty to do what is right.

Acknowledging uncertainties around the upcoming presidential election, we foresee positive stock market outcomes in 2024 and beyond. Favorable economic conditions, coupled with AI’s transformative impact, set the stage for sustained growth.

We remain dedicated to navigating these dynamics on your behalf. Should questions arise, please reach out. Thank you for your unwavering trust and partnership.

Warm Regards,

Kessler Investment Group, LLC

All information in this presentation is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. All economic performance data is historical and not indicative of future results. The market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Certain statements contained within are forward looking statements including, but not limited to, statements that are predictions of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Please consult your adviser for further information.

Opinions shared in this presentation are not intended to provide specific advice and should not be construed as recommendations for any individual. Please remember that investment decisions should be based on an individual’s goals, time horizon, and tolerance for risk.