Heading into the 9:30am ringing of the opening bell, the Dow Jones Industrial Average (“DJIA”) was set to open down 450 points from yesterday’s close. Does this mean stocks are finally crashing and wiping away all those gains since the Great Recession of 2008?

As I glance at the calendar, I notice that we are in the third week of October. The Crash of ’87 AND the 1929 Crash happened in the third week of October, right? Surely, this means that stocks are headed for a crash, right? There are simply too many negatives in the news and stocks have been on a “sugar high” of tax cuts and deregulation, right? A quick scan of the news reveal headlines filled with election rhetoric, descriptions of state-sponsored murder, trade tensions persisting, BREXIT complications coming to a head, the Federal Reserve is going to raise rates forever into the future, etc. Surely these scary headlines are going to sink stocks, right?

Well, maybe. However, I do not think so. I believe a turn higher is coming. It may come after a few more days of down days in the market, but we sense it is out there.

Stock corrections are something every investor knows happens from time to time. Experienced investors understand from experience that corrections are a healthy event necessary to keep the long-term uptrend intact. Yet, every time a correction is upon us, it feels as though the end of the world is upon us. It is human nature. It is why stock investing requires patience and understanding.

As someone who has been a professional in the investing business for over 26 years, I have learned to steel myself against the instinct to run for the hills. I have developed a sense of humility that keeps me grounded when times are good and a sense of confidence that helps me recognize an opportunity versus a threat. This sell-off represents more of an opportunity than a threat.

On the topic of professional experience, it is also worth noting that there is an army of portfolio managers and brokers who are 10 years into their careers. These professionals have never experienced a recession or a bear market or a crash. These events will happen in the future. It will be interesting to watch how these folks react to such an event. As they say, “A calm sea does not make a skilled sailor.” Making sure that your funds are entrusted to a seasoned professional is always something to consider.

An important part of determining whether a correction is headed to a full-blown crash is to take a step back and look at economic indicators and investor sentiment. This is far from an exact science which is what so many investors would like to see. Markets are not measured in the same precise way as those terrific engines made by Cummins, Inc. They reflect human behavior in the short run and earnings over the long run. There are bumps along the way.

Stocks will continue to move higher until a recession is at hand. As I look at the economic indicators, a few of them could weigh more heavily on the market if they turn lower. However, there are several more indicators that suggest we are still many quarters away from a recession. Bond yields are still moderate and while they have spiked a bit of late there is only a modest chance that they will continue to climb at the same rate. Corporate profitability remains strong and unemployment has not turned higher.

The “text book” tells us that the Federal Reserve will send the economy into recession by raising rates “too much.” Recent comments by the Fed chairman have spooked investors into thinking that the Fed will in fact do this sooner than later. I think this fear is over blown. In fact, I believe the Fed has acted in a very prudent and measured way. Sure, this tempered approach can change in the future but my read of the current Fed chairman suggests he will not raise rates without regard for economic conditions.

The “step-back” I encourage our clients to take is the same one I have been forecasting since the Great Recession. The Fed took a “kitchen sink” response to the financial crisis in the form of unprecedented monetary stimulus. The purchase of securities through “Quantitative Easing” had never been tried before on the scale it was used following the crisis. The strategy, for the most part, worked. It stands to reason that unwinding such a policy and getting back to “normal” is going to go a bit bumpy.

Think of what the Fed did as you would blowing up a balloon. The Fed essentially blew “air” (read: stimulus) into the economy to re-inflate it. Now they need to let the “air” out. As everyone knows, if you moderate the air flow, a balloon will deflate smoothly. It is almost impossible to deflate it this way. It will deflate in spurts as you try to keep the airflow consistent. But, if you just release the balloon all at once, it will make a funny sound and fly across the room. There is a fear in the market that the Fed will just release the “balloon” by raising rates quickly and removing all the stimulus at once which would cause the economy slip into recession. I think the Fed will continue to moderate the flow of “air” and, while there will be some “squeaks” and “gasps”, they will successfully remove the stimulus leaving the economy on firm footing and with no more artificial effects from monetary policy.

As the stimulus is removed and rates trend higher, stock prices must recalibrate to these new rates. This has as much to do with the volatility as any geo-political events in the headlines. Sometimes stock prices simply get a little ahead of where the underlying fundamentals can support them. I think this describes the majority of what is going on.

As for how low stocks could go, I am looking at the S&P 500® Index level of 2,700 as the nearest level of support. The Index dipped below this level earlier this morning before moving to the highs of the day. If the Index should fall below this level with conviction, I expect the lows from earlier this year to offer support. This means 2,550 could be tested. This means I believe we could see a further 5% decline from here if markets get spooked further. Unless there are material changes to the underlying strength to the economy I do NOT believe we will experience such a decline.

What I believe is more likely to happen is more volatility to occur over the next two weeks heading into the election. On the other side of the election (regardless of the outcome), investors will turn their attention to the strong economy and the realization that the world will not end based on the current headlines. Further, attention will turn to the meeting between Presidents Trump and Xi at the end of November. This meeting could mark a change in the direction of trade tensions between the U.S. and China. If so, stocks should react positively.

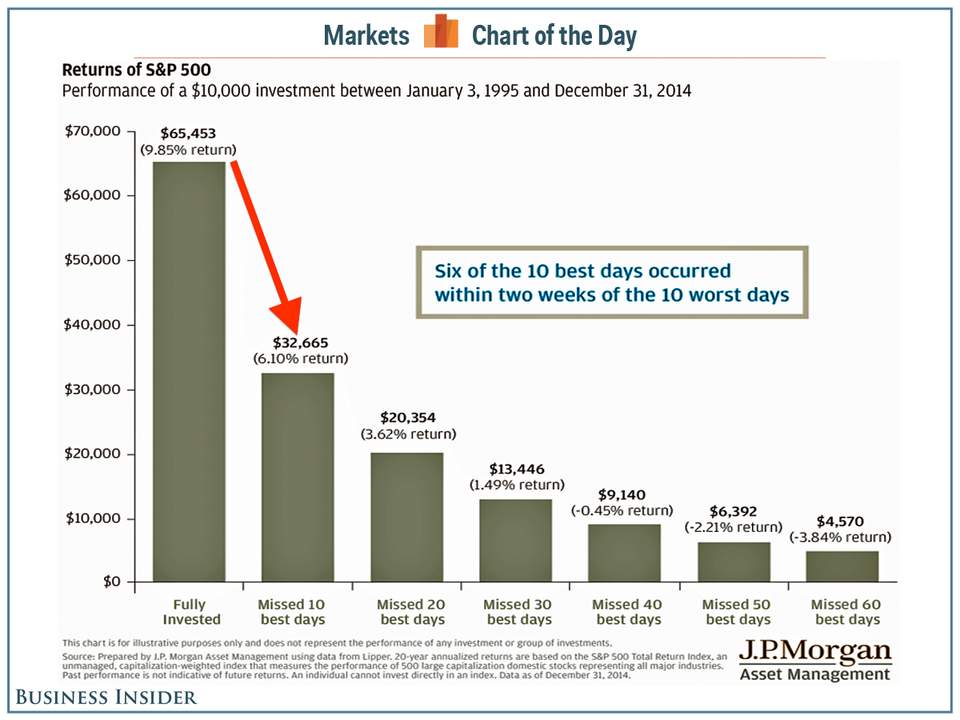

For those who are inclined to sit this decline out and just wait for stocks to recover, I offer the chart below. It shows the dramatic effect of missing the days in which the biggest jump in stock prices occur. Again, it is human nature to feel the pain of a decline more than the euphoria of a gain. This can lead investors to moving out of the market when they feel the decline (sell stocks AFTER they have dropped) and wait too long to buy back in (buy stocks AFTER they have gained). While I am not a strong proponent of the “buy and hold” strategy, as this is more lazy than effective, I do practice the principle of trimming stocks that have met our near-term price target and then using those funds to buy stocks during downturns like we are in now. This is not an exact science and does not always ensure a positive result. But, it does keep me disciplined during downturns, so clients will not miss the big “up” days.

There is no coincidence that where you find the days with the largest gains you also find the days with the largest losses. So, it is important to temper enthusiasm when markets rally. However, it is even more important to temper your despair when markets sink. Not every decline will turn into a 50% decline as we saw in the Fall of 2008.

On a final note, it is not uncommon to hear from clients and friends that they are “done with stocks” and moving to an “engineered” investment product. Something like an annuity. As a fiduciary, it is our obligation to offer un-conflicted advice and always put the interest of our clients ahead of the firm’s. This means that understanding, as well as providing a variety of solutions is integral to our ability to act as a fiduciary. Sometimes that solution leads us to recommend an annuity. It is an extremely rare event and never in response to market volatility. Nonetheless, annuities tend to become more attractive to some investors during periods of market volatility. While these engineered products can offer an appropriate solution to a financial problem, often they are misunderstood and misused. I offer the article below for anyone considering the use of an annuity.

Sincerely,

Kessler Investment Group, LLC