We expect stocks to rally from current levels. It is too soon to tell whether the rally will stick for more than a few percentage points but a meaningful low in stock prices is near. We still see a chance that stocks could put in a new low for the year but the prospect of another 10%+ decline is remote. Regardless, we believe stocks will move higher than current levels by the end of the year.

The Federal Reserve will raise interest rates later this month. There is a good chance they raise by a full 1% but for sure a 0.75% hike should be expected. The Fed is in full “Whip Inflation Now” mode. The difference between 1974 and today is that the Fed will do what is necessary to bring inflation down.

The problem with the Fed doing today what it failed to do in 1974 is a recession is inevitable. The benefit of the Fed doing today what it failed to do in 1974 is the recession will be shallower than what we experienced through the 1970s. Think the recession of 1990. Low growth instead of negative growth.

Earlier this year we advised clients to expect a “long hot summer” for stocks. We suggested investors would experience several 5-10% rallies followed by equal declines as the excess liquidity from COVID stimulus burns off. The excess is largely burned off and stocks are poised to move higher.

Following is a what we expect to see from the Fed, stocks, and economic data in second half of 2022:

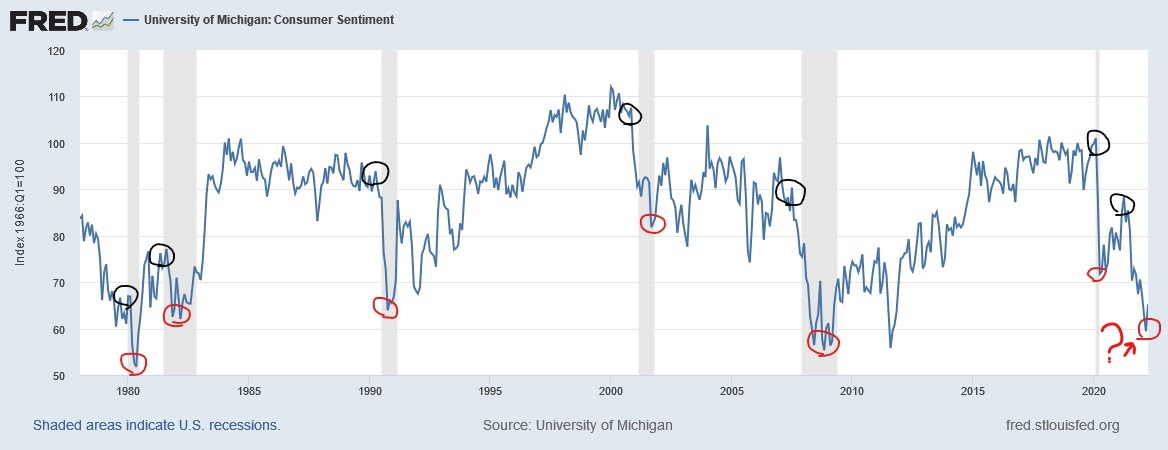

- During the 1990 recession, stocks bottomed at the same time economists were beginning to acknowledge a recession was even in the cards. We believe the same is happening right now.

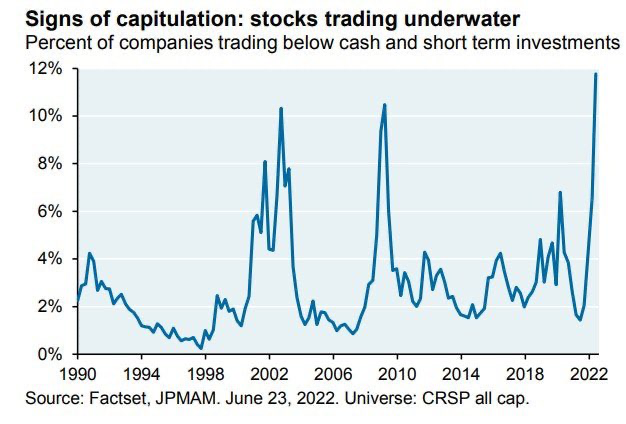

- The number of stocks trading at values below the amount of cash on their balance sheet has climbed to a level not seen in over 30 years. (See chart #1 below.)

- The money supply (liquidity) is coming down. Monetary economics tells us that reducing the money supply will snuff out inflation. There is a lag effect between the decline in money supply and inflation moderating. (See chart #2 below.)

- While inflation is declining, unemployment will start to rise. Layoffs will grow as companies try to “right size” following the COVID era. Most of the layoffs will come from companies that thrived during COVID like Amazon, Tesla, Crypto-based companies, etc. Unemployment sits at near an all-time low. An uptick in unemployment following the economic slowdown should be expected. (See chart #3 below.)

- During the 1990 recession, stocks bottomed coincident with economic indicators pointing to recession and not after. In fact, stocks rallied once it became apparent a recession was at hand. We think stocks have bottomed or will in the next couple of weeks. (See chart #4 below.)

Chart #1

Chart #2

Chart #3

Chart #4

(Point 1= Recession starts before economists agree, Point 2= Market bottoms after 20% decline, Point 3=Economists agree that recession has begun)

In conclusion, we are decreasing cash and increasing exposure to stocks in our managed accounts. We expect the Healthcare, Information Technology and Communications sectors to lead other sectors out of the bear market. Stocks we plan to add to managed accounts are expected to come from these sectors.

Investors who fear that an official declaration of a recession marks a time to sell stocks will regret such a decision. Now is the time to invest in high-quality stocks with an eye on the recovery. (PAST PERFORMANCE DOES NOT PREDICT FUTURE RESULTS.)

Sincerely,

Kessler Investment Group, LLC

All information in this presentation is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. All economic performance data is historical and not indicative of future results. The market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Certain statements contained within are forward looking statements including, but not limited to, statements that are predictions of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Please consult your adviser for further information.

Opinions shared in this presentation are not intended to provide specific advice and should not be construed as recommendations for any individual. Please remember that investment decisions should be based on an individual’s goals, time horizon, and tolerance for risk.