With the beginning of the Senate impeachment trial and the recent breakout of the “Corona” virus, stocks have taken a breather from the strong rally that kicked off 2020. The recent sell-off did not take us by surprise. During the Clinton impeachment, stocks rallied ahead of the Senate trial before selling off by approximately 3.5% only to rally once the trial was over. It is this kind of “fits and starts” move in stocks that we expected.

In keeping with our discipline, we have been selling select stocks in our managed accounts during the recent rally. By raising cash (selling stocks), we believe we have positioned our managed accounts to take advantage of stock prices during this sell-off.

While stocks are rallying today, we are skeptical that the sell-off has run its course. Nonetheless, we remain more invested than not as we believe the overall environment remains solid for stocks. We simply want to take advantage of what we believe will be a spate of volatility over the next few weeks. It is always our goal to improve the quality of holdings in our clients’ accounts during these periods.

The other factor affecting stocks is the so-called “Corona” virus. By disrupting travel and increasing concerns over safety, investors are given a reason to “ring the register” on their recent gains. Despite the tragic effect on those afflicted with the virus, we do not have a concern over any long-term impact on the market.

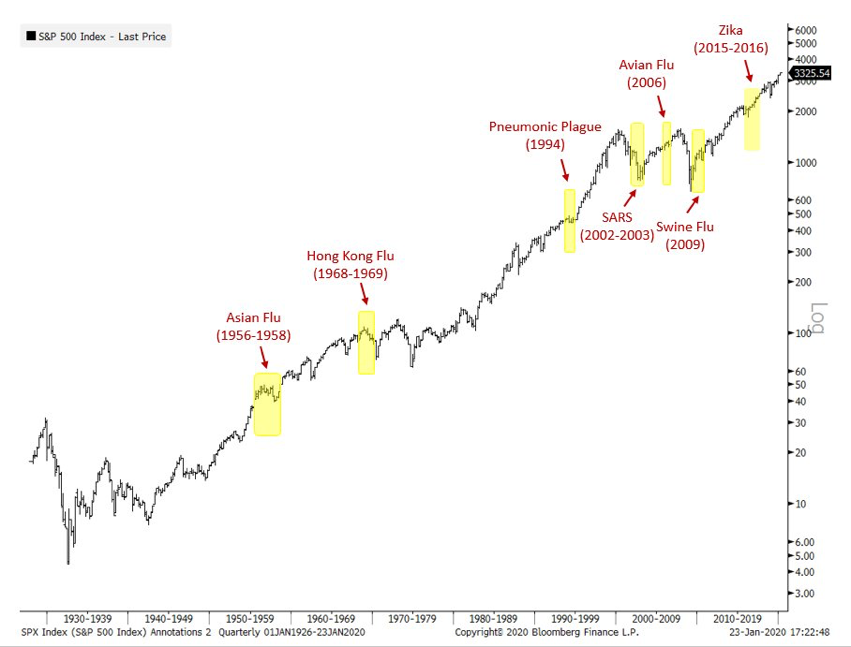

Below is a chart which highlights the performance of stocks following some of the noteworthy outbreaks over the last century. Of course, past performance does not give us any way to predict future performance for stocks. For us, we think it offers us something to contemplate as we wait for more information on the virus’s impact.

Once the Senate trial is over and fears of the Corona virus subside, we expect stocks to move higher, albeit from slightly lower levels than today. We expect the rally in stocks to be fueled by TINA (There Is No Alternative) and FOMO (Fear Of Missing Out). Never underestimate the power of fear or greed when it comes to the human spirit.

We also see an increasing chance that the Federal Reserve lowers interest rates one more time. We see the odds as less than 50% but the recent data showing weakness in the industrial sector and global virus fears could lead the Committee to act. This would push stocks much higher if it were to occur.

For now, we are looking for companies whose stock price has suffered due to the recent sell-off. We are seeing opportunities in energy, metals, consumer goods and financials. While we expect stocks to be higher by the summer than they are today, we remain patient for a better opportunity to work the cash we have raised for clients.

Sincerely,

Kessler Investment Group, LLC