There is a stock market adage that goes something like this, “As goes January, so goes the year.” Well, stock market adages are born from experience and die from anticipation. In other words, once an adage gets some notoriety, it tends to shift or fade away as the behavior of investors change in response to it. We think this adage may indeed be fading away.

In the past 19 years, the S&P 500 Index has had negative performance for January 10 times. In all but one of those years (2008…Remember the Financial Crisis?), the Index delivered a positive result over the final 11 months of the year. The most recent example was 2021 and, for good measure, the same was true in 2020. In fact, 7 of those 10 years saw a double-digit positive return for the entire year. (Past performance does not guarantee future results.)

Recent history is in the process of writing an all-new adage about January’s tell on the rest of the year. Will 2022 add to the trend of January’s delivering a false read on the rest of the year? Of course, we will not know for another 11 months, but we think so.

There are several indicators we watch that suggest the sell off in stocks is nearing an end. Trends typically change when it “feels” like the current trend will go on forever. This is true regardless of whether that trend is up or down. If the current downward trend in the small-company Russell 2000 Growth Index continued at the same pace, that index of over 1,200 stocks would reach 0.00 by Memorial Day. This is a ridiculous expectation which means a change in the current downward trend is ahead.

Following are a couple of charts to make our point that stocks are oversold and approaching a reversal in trend and will start moving higher soon:

The first chart measures the spread between the “bullish” and “bearish” sentiment among members of the American Association of Individual Investors (AAII). For years, this ratio has been used as a contrarian indicator. In other words, when this group of investors gets enthusiastic (“bullish”) about stocks it tends to line up with a top in the market ahead of a decline. The opposite is true when this group skews “bearish” as they are right now. As the chart shows, these investors have not been this bearish on stocks since July of 2020. As we know, stocks performed well after July 2020. (Past performance does not predict future results.)

The next chart shows the number of stocks making fresh 52-week lows in the New York Stock Exchange Composite Index has risen to the highest level since March of 2020. This is an indicator used to gauge negative sentiment. When measures of negativity in stocks reach an extreme, we grow more positive on stocks, at least in the near term. (Past performance does not predict future results.)

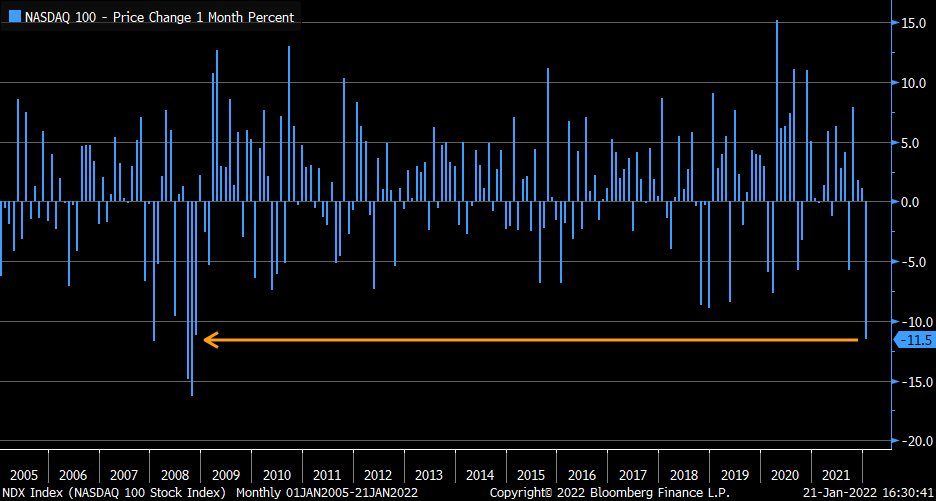

As of last week, the NASDAQ 100 (The largest 100 companies in the NASDAQ Composite) is down 11.5% in a month. The next chart shows that the NASDAQ 100 has not declined this much in a month since the Financial Crisis of 2008. Is the world on the same precipice of collapse that we saw 13 years ago? We do not think so. (Past performance does not predict future results.)

If the specter of inflation is what investors believe will bring stocks to their knees, then look at the following chart of 5-yr inflation expectations. As you can see, the futures market has longer term inflation sitting just below 2.5%. One can argue that this is the sweet spot for inflation and a far cry from the hyperinflation of 7%+. We think inflation trends lower over the next 6-12 months and stocks respond positively as a result. (Past performance does not predict future results.)

What we know is on the mind of most of our clients is; Inflation, the Federal Reserve, the upcoming election and whether stocks are preparing to tumble. Let us look at each of these issues.

On the topic of inflation there is much to say, but we will keep it brief. What we believe is that the spike in inflation to 7% is indeed transitory. This is not 1980 when inflation peaked at over 13%. This is not even 1974 when inflation first hit 7% on its way to 13%. The economic conditions today simply do not line up with those of the 1970’s and early 1980’s. Just because one data point (inflation) lines up with a particular period does not mean one should expect the same outcome when few other data points are in alignment with that time.

We are not looking through rose-colored-glasses. There are economic conditions that exist today which could lead to serious outcomes. Yet, that is more often the case than not through history so this, in and of itself, is not concerning to us. Nonetheless, we maintain an eye on what could go wrong in the economy and the market and stand ready to respond.

As for inflation and its impact on the economy and the market, we do not believe the negatives will outweigh the positives. The negatives are easy to list. Here are a few:

- Higher prices paid by buyers.

- Lower prices received by sellers.

- It is a drag on the economy.

- It negatively affects the behavior of consumers.

- It can lead to layoffs as manufacturers try to reduce input costs.

While there are few benefits to inflation, let us remember that we have been living with inflation’s evil twin…. deflation, and its cousin…disinflation since the Financial Crisis of 2008. While inflation is “bad”, deflation is “worse.”

The positive offsets to the return of inflation are as follows:

- Workers are finally experiencing a bump in wages.

- The energy sector (a major economic force in this country) has recovered from $20 oil.

- The banking sector (a major contributor to economic activity) is now benefiting from higher interest rates on loans.

- Retirees, living on fixed income, are about to experience a bump in the interest paid on their deposits.

- The threat of deflation has been all but destroyed. (This might be the most important offset.)

Expect inflation to take center stage later this year during the election. Expect the entrepreneurial spirit to take over and deliver productivity gains that offset inflation. Expect a bump in wages to translate into more spending. Expect senior citizens to benefit from higher rates on CDs and other fixed interest rate securities. Expect the Fed to recognize that, while inflation has returned, it is not 1980 so there is no need to panic.

The Federal Reserve is in a tough spot. The greatest risk to the economy lies with the Federal Reserve and its response to inflation. If they raise interest rates too much, they risk sending the economy into recession. If they do not raise them enough, they risk pushing inflation higher. This is not a new threat to the Fed and the current Chairperson has the experience to lead the Fed through this environment.

So, if the future for stocks looks attractive, why do stocks act like the end of the post-COVID rally is upon us, IF NOT THE END OF THE WORLD according to some? We believe the current decline is simply a reset of where investors are looking for growth. When the Federal Reserve signaled to investors that they will be raising rates this year, the “winds of the market” shifted.

Stocks act differently during cycles when the Fed raises interest rates from those cycles when they lower rates. This does not mean stocks do poorly, it simply means investors shift from stocks they felt comfortable owning in a 0% interest rate environment to stocks they would rather own in a rising interest rate environment.

It is this shift that leads to volatility, and it is volatility that increases fear. It is fear that leads to selling and it is selling that leads to bargains. Despite a growing connection between the two, the stock market is not the economy, and the economy is not the stock market. There are times when they disconnect from one another and that is what we are witnessing now. The economy remains solid. This is not the economy of 2008, and it is not the economy of 1980. It is reminiscent of the economy of the late 1980’s and early 1990’s. One that is shifting gears before it accelerates again.

So, what about the Fed and what we expect regarding interest rates? We expect the Fed to raise interest rates 3 times this year. Rate hikes in March, April and May seem to be in the cards. After these moves the Fed may take a wait-and-see approach. Let the dust settle and maybe use the Balance Sheet to do more work.

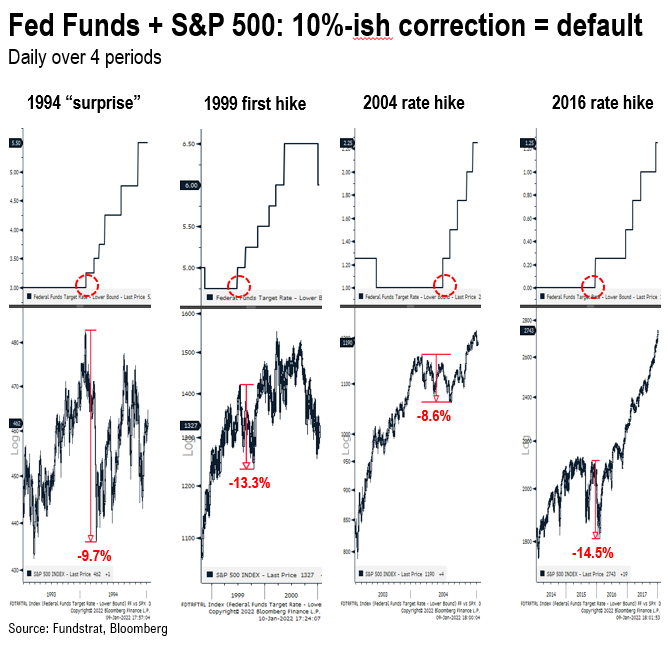

Below is a chart showing how stocks have performed following an initial rate hike. It could be the case that we have seen the decline associated with such a rate hike before the Fed actually pulls the trigger. Time will tell but we think volatility will remain for a couple quarters.

There are many who think 4 hikes are in the cards. There are some who think the Fed will raise 50 basis points in March. I think we are now starting to hear more from people sharing what they WANT the Fed to do rather than from those who share what they THINK the Fed will do. If you are an investor positioned to benefit from an aggressive Federal Reserve, then you might be motivated to pile on to this scenario for personal benefit versus helping your clients. Just a thought.

Regardless, the current Fed learned a lot during the last rate cycle that ended in December of 2018. They will not contribute to problems facing the economy, and they will do what is necessary to nurture it. Therefore, I think we see more of a steady and measured Federal Reserve rather than one trying to rapidly get ahead of the curve.

The upcoming election will push the topic of inflation and the debt to center stage. We think Republicans stand a good chance of regaining the House of Representatives. If this happens, it bodes well for stocks. Stocks tend to perform well with a Democrat President and split Congress. We also believe that both Democrats and Republicans will call for higher taxes.

The chart below offers a look at how stocks have performed during the 16 quarters of the President’s term. As it shows, the 2nd and 3rd quarter of the President’s 2nd year have performed poorly versus the other quarters. (Past performance does not predict future results.)

While we believe stocks will end 2022 higher, we also think a recession is on the horizon. With a hike in taxes and a Fed that is raising interest rates, albeit slow and steadily, it should not come as a surprise that the economy might recede. However, a recession is a healthy and natural occurrence for an economy like ours. We have our eye on 2023 for a recession but still expect 2022 to deliver good results for stocks.

This brings us to the question of where to invest in 2022. We believe the broad stock market to deliver another solid result for 2022. However, we think the second and third quarter of the year could be rough for stock investors. Below we show a chart that suggests the 2nd and 3rd quarter of a president’s second year in office can be rough. The 4th quarter, however, has shown to be a solid one for stocks. (Past performance does not predict future results.)

In the second chart below, we show how stocks tend to stumble following the initial rate hike by the Federal Reserve. We expect the Fed to raise rates at the March meeting. This initial rate hike could lead investors to fear the Fed might raise rates more times than the economy can handle. (Past performance does not predict future results.)

In conclusion, we think stocks will turn higher in the next day or so. This turn higher might take us through the end of March and into April. They should remain volatile along the way as investors shift their footing and reshuffle their deck of stock holdings. We will use such a rally to raise cash for our managed accounts in anticipation of a rough 2nd and 3rd quarter. Maybe the lows are in for the year but if they are not, we want to be prepared for the rally we see later this year.

A recession is coming but it will not be this year. Many will mistake the volatility in stocks as a signal that the economy is entering a recession or that a crash is imminent. We do not subscribe to this view. A recession is unlikely until we get into 2023 and a crash of more than 20% is unlikely. While recessions are tough on stocks, there are sectors and industries that perform well during these cycles. We will focus our attention on these areas of the market when the time comes. In the meantime, we remain vigilant as we work to protect our clients’ portfolios and deliver results into the future.

P.S.: We want to take the opportunity to announce to clients the addition of Daniel Gretzinger to our team. A recent graduate of University Wisconsin-Whitewater, Daniel will assist the Chief Investment Officer by conducting stock research and contributing to the KIG market outlook.

Sincerely,

Kessler Investment Group, LLC

All information above is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. All economic performance data is historical and not indicative of future results. The market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. Certain statements contained within are forward looking statements including, but not limited to, statements that are predictions of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks and uncertainties. Please consult your adviser for further information.

Opinions shared above are not intended to provide specific advice and should not be construed as recommendations for any individual. Please remember that investment decisions should be based on an individual’s goals, time horizon, and tolerance for risk.